Authors: Girum Abebe and Christina Wieser

Beyond public health concerns and chilling epidemiological outcomes, the economic and social impacts of the COVID-19 pandemic have been unprecedented. According to the World Bank, for example, Africa will likely face recession for the first time in 25 years and the ILO estimates that the COVID-19 pandemic is likely to lead to a loss of 29 million jobs and to a nearly 10 % fall in labor income in Africa in 2020 alone Share on X. A sharp drop in consumer spending, weakening liquidity, fall in investment, and a slump in international trade have led to closure of businesses and substantial contraction in output. Business closures either due to worsening economic conditions or mandatory lockdown measures are likely to produce a drastic reduction in labor demand triggering job losses, cuts in working hours and wages.

To understand how the COVID-19 pandemic affects jobs and businesses, the World Bank, in collaboration with the Job Creation Commission (JCC), has implemented a high-frequency phone survey of firms (HFPS-F) in Addis Ababa, Ethiopia. The HFPS-F interviewed a random sample of firms in Addis Ababa every three weeks for a total of eight survey rounds between April and October 2020. Using data from HFPS-F, a series of briefs on how the pandemic impacted labor demand, firm operations, adaptions, and future expectations were produced. This blog highlights four key insights on the state of business closure and jobs during the pandemic.

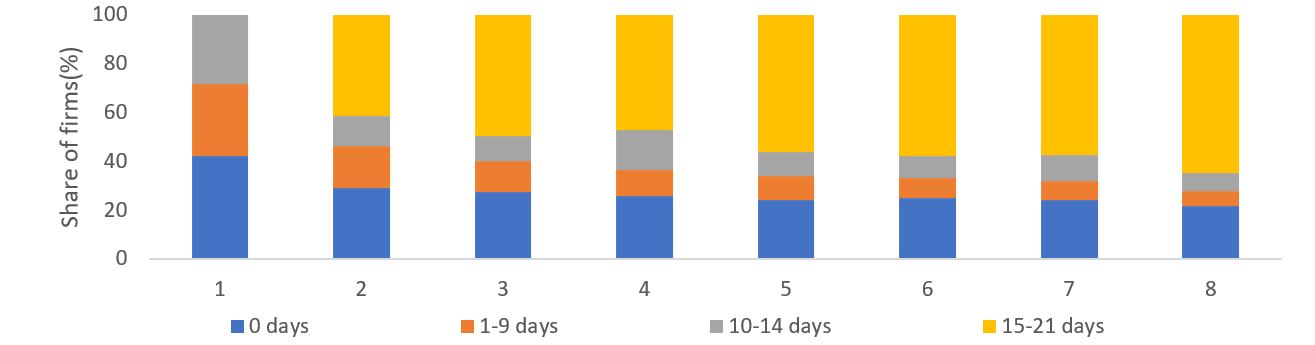

- The pandemic has pushed many businesses to either substantially scale back or completely suspend operations: At the onset of the COVID-19 pandemic, in April 2020, nearly 42 percent of businesses in Addis Ababa closed Share on X (Figure 1). Firms that had remained operational suffered significant negative consequences — they froze hiring, furloughed workers, reported immense losses in sales revenue and profit, and had downbeat expectations for the future. In subsequent months, as restrictions relaxed, a gradual reopening of businesses was observed, and outlooks improved. Nevertheless, nearly half a year into the pandemic, a quarter of firms in Addis Ababa remained closed, and by the last survey round, in October 2020, about 21 percent of these firms were yet to resume operations. Share on X

Figure 1. Days of operation across survey rounds

Note: The surveys were conducted roughly three weeks apart. The round 1 survey took place in April 2020, and round 8 in October 2020.

- Amid business closures, few firm owners took up alternative jobs, with the majority remaining idle or were engaged in non-paid household activities (40 percent). The idle capacity and extensive underutilization of scarce resources constitute a loss to the economy that is hard to estimate. There were few firm owners who were productively employed whilst the business is temporarily closed — about 9 percent of the business owners took up wage jobs and 16 percent were engaged in other self-employment activities to support their livelihoods.

- Layoffs have generally been low possibly due to effective government regulations: A key provision in the State of Emergency (SoE) – which was put in place between April and September 2020 to contain the spread of COVID-19 and lessen its potential impacts on the economy – prohibited firms from terminating active contracts with workers and landlords from increasing rental fees and evicting tenants. Apart from the early shedding of workers in the initial few weeks of the pandemic, layoffs had been generally low — about 4 percent of firms reported layoffs in April 2020. Few firms (3 percent) attributed the limited layoffs to the need to comply with the SoE, and instead firms mostly chose to grant paid-leave to their workers. In fact, when the SoE was lifted in September 2020, we did not find evidence of a significant uptick in layoffs.

- Real wages appear to be severely affected by the COVID-19 induced crisis. With many firms either closed or working shorter hours, workers in Addis Ababa were paid significantly less than pre-COVID-19. Compared to April 2019, for example, real wages for high skilled workers declined by 14.1 percent and low skilled workers by 3.7 percent in April 2020. The fall in wages is more drastic among high skilled workers in the service sector (14.7 percent drop compared to the same month last year.

Looking forward

Jobs are important pathways out of poverty in Ethiopia and protecting them is imperative: While reported layoffs have been generally low, reductions in cash flow and mounting losses make existing jobs susceptible to layoffs and new hires and wage growth unlikely. The SoE might have provided a much-needed reprieve for vulnerable workers, and, fortunately, its lifting in September 2020 did not result in massive layoffs. But as the economy teeters on the road to recovery, the impacts of the pandemic on firms and jobs still lingers and uncertainty permeates the future.

In addition to preventive measures aimed at containing the spread of the virus, keeping firms operational should be a key policy priority: Support that bridges the financial needs of firms in the interim offers them a lifeline for preventing firm closure or downsizing. In fact, when firms were asked to indicate policy levers that the government should use to help them weather the COVID-19 induced crisis, many indicated tax waivers and financial support to be key interventions. To its credit, the Ethiopian government has already approved support packages that extended debt relief, tax waiver as well as additional income tax incentives for firms who retain and pay workers even when the firm is closed for the first few months of the pandemic.