Authors: Dalal Moosa and Federica Saliola

This blog is also available in Arabic.

Today, the world is seeing an unprecedented freeze on work and production, a repercussion of the spread of the coronavirus (COVID-19) and the measures taken to confine it. While the health impacts of COVID-19 are still uncertain, the recovery may present countries in the Middle East and North Africa (MENA) region with an opportunity to revamp economic systems, Share on X reach out to more workers and businesses, and propel their digital economy.

The virus impacts jobs through its effect on labor supply, particularly through worker health and mobility, and its effect on business activity. It is slowing down demand for goods and services, reducing the supply of inputs, tightening liquidity, and raising uncertainty. This may be especially challenging for MENA for several reasons:

- State dominance of economic activity and limited competition have weakened the private sector. Informal economic activity is rampant in terms of production (estimated at 16-35% of GDP) and employment (estimated at 50-74% of those employed). This is amplified by the fact that many in the region work in the service sector, which is significantly affected.

- The region’s digital economy is still in its infancy: businesses and people encounter obstacles putting technology to productive use.

- The region relies on imports, estimated at 39% of GDP, a share higher than any other developing region, while the share of food in imported merchandise, at 12%, is also the highest. Shocks to global value chains can have severe consequences on consumption and food security.

- The plunge in oil prices affects MENA’s oil-exporting countries by reducing the value of their exports and constraining their fiscal space.

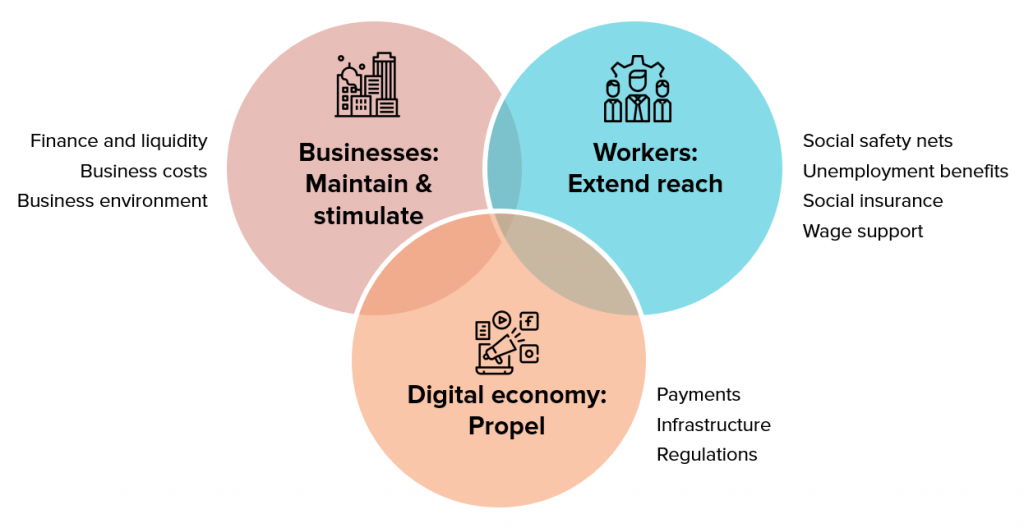

These factors make it more necessary than ever to support workers and businesses and propel the digital economy forward.

Cushioning the economic downturn

Supporting workers

Governments have relied on expanding social assistance to alleviate the shock. Jordan and Tunisia, for example, are extending cash transfers to new households. While these measures are important, they highlight the need for reforms.

Social safety nets remain small, at about 1% of the region’s GDP (versus 1.5% in Latin America and the Caribbean and 2.2% in Europe and Central Asia), despite high poverty and vulnerability rates. Expanding them, and eventually improving their targeting, will be crucial.

Unemployment benefit schemes have not been effective, especially due to high informal employment, which restricts their source of funding. Share on X This has left governments scrambling to identify and reach out to informal workers. Some have turned to innovative solutions, such as supporting RAMED-card holders in Morocco. Gulf Cooperation Council – GCC – countries appear to be better positioned, using accumulated funds to support wages, as in Bahrain. Saudi Arabia could also expand its (non-contributory) unemployment assistance scheme, Hafiz, one of the few in the region.

Governments could also reach workers by expanding their wage support measures, making sure, at the same time, that the region’s already small, formal private sector does not disappear. Some programs, such as those in Algeria and Tunisia, could be expanded.

Governments could also waive social security contributions, potentially a cheaper option, as in Jordan and Morocco.

These systems, however, all suffer from capacity issues. Reforms in the short term could lay the foundations to strengthen their design and effectiveness over the long run.

Looking after businesses and stimulating them

Only the Gulf Cooperation Council – GCC – countries appear to have begun targeting businesses, likely due to their better fiscal space. Bahrain, Oman, Qatar, and the UAE are taking steps to preserve their private sector, from deferring loan installments for small and medium enterprises (SMEs) to providing wider exemptions for rent and utilities.

Other countries must follow suit. This is important because of the large share of microenterprises and SMEs in the private sector and the share of workers employed by them.

This could also be an opportune time to tackle the root challenges the private sector faces, namely: (1) limited market contestability, calling for fair competition; (2) limited access to the capital that is often channeled to large firms, calling for financial sector development, including fintech and digital payments; and (3) the limited technological capacity of firms, calling for digital transformation, which could also allow businesses to adapt faster to the new reality of social distancing.

Investing in digital transformation

The COVID-19 crisis is set to amplify the adoption of new technologies.

The region can ramp up its response capacity through digital technology, with many governments already considering direct financial transfers to households and small businesses. A well-functioning ecosystem of digital government-to-person (G2P) payments can make these transfers more effective and inclusive.

Digital technology is also improving people’s ability to work from home and raising the operational resilience of businesses. It is also playing an important role in access to health. Beyond the current outbreak, investing in the digital economy would enable MENA to transform itself economically and create jobs. Success stories, such as the ride-hailing app Careem and online marketplace Souq — already bought by international giants — have put the region’s technology industry on the map for global investors.

Yet much remains to be done to seize these opportunities and build the digital infrastructure needed.

The region has some of the world’s most underserved internet users: per 100 inhabitants it has fewer than 10 broadband subscriptions, in contrast to 120 mobile phone subscriptions. Bandwidth is limited, so while many citizens are active on social media, the internet is rarely used for launching new enterprises. Digital finance has barely any presence, and digital G2P is also limited.

New measures and their budgetary implications will, of course, depend on each country’s priorities and its fiscal space. But if short-term initiatives link to medium- and long-term objectives, they might better serve the region’s people, the private sector, and the overall economy.

This is the fifth blog on ways to protect workers and jobs in the COVID-19 (Coronavirus) crisis, based on a World Bank Jobs Group Note: “Managing the Employment Impacts of the COVID-19 Crisis, Policy Options for the Short Term.” Upcoming blogs will cover the role of unemployment insurance; and policy options for the recovery phase, such as digitally-enabled public works; and addressing gender dimensions of the jobs effects of the COVID-19 jobs crisis.

.